a discourse analysis

beatrice mulewa & samuel st-pierre theriault

While examining what is said and done by the government, it is worthwhile to consider the possibility of social transformation, and conceiving of the world in an alternative way. As a community organization, Project Genesis advocates for this alternative viewpoint. Project Genesis is critiquing the government’s language and discourse. By deconstructing the government’s rhetoric and discourse to combat poverty, it outlines how the Quebec government oppresses the poorest classes of our society by not providing them with the proper means of survival and social equity that they deserve: it perpetuates stereotypes and prejudices which do nothing to improve the quality of life of most welfare recipients.

According to the government’s own reports – the action plans, Bill 112, statistic indexes etc, all designed to combat poverty and assist people on welfare – what has been implemented still hasn’t been successful in wiping out poverty. What comes through in these reports is government consensus on what has been said and agreed upon to be the right way of solving social exclusion. Evidently, poverty still manifests itself today in Quebec, yet society at large has false notions about people on welfare. The failure of past actions to solve the problem thus prompts other alternative measures.

What the government has done, such as creating social programs that assist welfare recipients (the various training and educational programs) are inadequate and often constrain its clientele who are stuck in dependency because of inadequate government transfers and the health, housing and education problems that come as a result of the ensuing poverty. The dependency that the government creates is a reality that questions governance. The government implements a minimal wage that low paid workers silently accept. Indeed the poor and low income earners are oppressed. They remain stuck on welfare for a long time. Consequently, to create social transformation, there is a need to review the negative measures of the government and a need to co-ordinate the actions of those who oppose oppression and unfair lives.

Within such a conceptual scheme, where organized coordinated actions are the constitutive grounding for communities and their social study, the problems of representation and non essential or weak identities are avoided. Hence, a community in its own discourse constitutes interrogation of suitable coordinated activities. Therefore a political self defense and training workshop provided by Project Genesis to welfare recipient is a necessary conceptual scheme to counteract subjective reality and provide a stronger basis for grounding social reality.

communities open to analysis

Following the adoption of Bill 112 in 2002, the Government of Quebec created an action plan in the spring of 2004. The plan proved largely ineffectual and the adoption of the second plan, scheduled for the spring of 2009, has been postponed to make way for more consultation. Consultations have already taken place a number of times. The Government of Quebec is only using this as a pretext to maintain the status quo and delay any effectual poverty reduction measures. The Government of Quebec has been inactive in the implementation of its own law. Its actions are contradicting its words and the Liberal government keeps showing that it is working for the richer elements of Quebec society while ignoring those who most need help. The Quebec Government needs to do more to improve the living standards of the thousands of people living in dire poverty because of insufficient welfare compensations, it needs to address the urgent need for social housing, and it needs to stop discriminating between different aid recipients.

a cost to society?

Many prejudices still exist about welfare recipients. These stereotypes are harmful to the people who, because they have no other choice, are forced to turn to the government for help. One frequent prejudice is that welfare is costly to society. This thinking ignores the fact that the cost of not providing social aid is actually higher as this increases homelessness, health problems and petty crimes or fraud The Quebec government has done nothing to attack this stereotype. In fact, the Quebec government through its actions has only helped to spread this and other prejudices. It has repeatedly refused to index the benefits of social aid recipients considered “fit to work” to match the rise in the cost of living. It has instead indexed their benefits at half the percentage, while indexing benefits of other recipients, considered “unfit to work” for the full amount. The government made the judicious choice of fully indexing all beneficiaries in January 2009. The results of the policy for 4 years starting in 2003 however were still to effectively reduce the purchasing power of aid recipients considered ‘fit to work’, therefore pushing these individuals even deeper into poverty.1

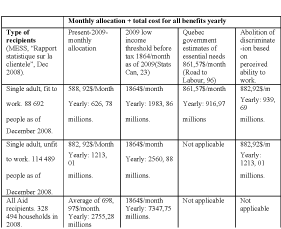

In 2008, the total cost of all direct financial aid provided by The Ministère de l’Emploi et de la Solidarité sociale (MESS) in Quebec amounted to 2,826 million dollars.2 In 2008-2009, benefits were distributed to a monthly average of 479,928 people.3 However, because of government discrimination and virtual categories, some types of recipients receive up to $294 less than others.4 The Quebec government has 2 programs for aid recipients: Social Solidarity, for individuals and families that have severe constraints to work demonstrated by a medical professional and lasting an unlimited or indeterminate amount of time; a second program called Social Aid is for people with no constraints or temporary working constraints. A comity in the MESS decides who is ‘fit’ or ‘unfit’ to work and have the power to ignore a doctor’s professional opinion. This discrimina¬tion is taking away an individual’s right to a decent life outside of poverty. It is also fuelling prejudices against individuals considered ‘fit to work’. Because of this arbitrary division, beneficiaries considered ‘fit to work’ are seen as lazy and unwilling to work which totally hides the reality that these individuals are not working because there is a lacuna of work to which their skills and ability are suited. The Quebec government argues that decent benefits would stop these people from going back to work. However, through its own actions, the Quebec government is handicapping these people by depriving them of the money necessary if they are going to bring themselves out of poverty (Comité luttes du FCPASQ).

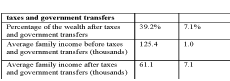

Annex 1 shows how much it would cost to raise the price of welfare to different levels. The Quebec government is constantly saying that they do not have enough money to raise bene¬fits to the most needy. The Quebec government is constantly saying that they do not have enough money to raise benefits to the most needy. This is the same government that prides itself on having reduced income taxes by 4.5 billion dollars from 2003 to 2008.5 In 2006 in Quebec, the richest 20% of the population made an average of 61.1 thousand dollars a year after tax and controlled 39.2% of the wealth. The poorest 20% of the population by comparison made an average of 11.1 thousand dollars and controlled 7.1 percent of the wealth after tax and government transfer.6Annex 2 gives a quick breakdown of those numbers and shows that government taxation and redistribution benefits the poorer segments of society. It is clear from these numbers that it is not the money that is lacking in Quebec. Rather, it is the political will and leadership needed to help eradicate poverty.

exploiting the system?

Common prejudice says that people who receive money from the government get a lot of money, or ‘they get free cable’. If only that was the case; however, the reality is that people living on welfare payments are for the most part living in misery. A single adult considered ‘fit to work’ receives $588.92/month in Quebec. He can make $200 a month working with all income over this 200$ being confiscated by the government. According to the government’s own estimates from a 1996 report entitled The Road to Labour Market Entry, Training and Employment, the government of Quebec set the ‘essential needs’ of an independent adult at $667/month.7 Indexed, this amounts to $861.57 in 2009.8 In this optic, only people presenting “severe constraints to employment” receive an amount that is sufficient to feed and house themselves properly and even they do not receive enough money because they are not always independent and require special services.9

According to an informal survey of people receiving government assistance conducted by Project Genesis, the average cost of housing and lodging alone came to $826/month. When social aid recipients were asked what they could not afford: 53.5% of respondents answered food; 51.2% clothes and shoes; 27.9% medical & dental expenses; 23.3% recreation, outings, vacation; and 20% said computer, internet, TV. 35% of respondents indicated that they would have to skip meals at least 5 times a month while only 12.3% indicated that they never had to skip a meal. When asked how these situations had affected their health, 50% of respondents reported that they were stressed, 32,4% reported feeling depressed, while 44.1% marked that they were being affected physically or mentally without specifying exactly how. When they were asked to give the Minister advice, some of the more striking comments included: ‘Make sure people’s needs are filled’, ‘try to live on welfare for a month’, ‘be more understanding regarding diseases that prevent people from working’, ‘welfare should help you get out of welfare for good and be a productive member of society’. It is nonsense that people in Canada, one of the richest countries in the world often have to skip meals, stop buying cloths, or have to stay at home due to their limited resources. These decisions should not have to be made. Welfare should provide for food, housing, transportation and communications, as well as basic recreation.

The Quebec government seems to think that social aid recipients are second class citizens. It shows this repeatedly by discriminating against them and their children. The government confiscates all child support payments after the first $100 dollars regardless of how many children this money is supposed to help. By doing this, the Quebec government is taking 46.5 million dollars a year away from the children who need it. This policy also affects students receiving money from the Loans and Bursaries Program who are subject to the same limits on child support payments.10 People receiving welfare aren’t even allowed to get help or gifts from friends or family without the Quebec government deducting it from their cheques. Policies like these only help push social aid recipients away from society and into the vicious circle of poverty. The Quebec government needs to get its priorities straight and stop taking money away from the neediest families in Quebec so it can give tax cuts to the rich.

Programs designed to help aid recipients complete their basic schooling are mostly aimed at people under 25. People over 25 are instead encouraged to study a trade or get a job that requires no training. The Program Devenir, asks participants to work 20 hour a week in a community organization for an extra $130 a month, that’s $1.63/hour.11 For the majority of the 61,803 people who haven’t finished their schooling and who are considered ‘fit to work’, To go back to school means they have to go through the Education Ministry’s Bursary and Loans program where they are forced to indebt themselves to finish their basic schooling. Who do these programs help, aid recipients who are forced to work at minimum wage and can’t receive the appropriate training, or businesses who get cheap labor subsidized by the government?

people on welfare don’t want to work?

A large number of people, if not the majority of welfare recipients, receive welfare because they are unable to work for family, health, age, or other serious reasons. According to MESS’s own statistics, at the end of 2008, of the 138 296 people receiving social assistance who were considered apt to work by the Quebec government, 7 147 had not completed primary school, 54 656 had not completed secondary school and 24 927 had no education past the secondary school level. 8310 people receiving social assistance lived in a region with an unemployment rate higher than 10%.12 Going further, out of this same group of 138 296 people receiving social assistance who were considered apt to work by the Quebec government, 54 423 people had been receiving welfare payments for more than 120 months cumulatively showing that the government strategy of keeping benefits low is simply perpetuating the vicious cycle of poverty.13

Government measures supposed to help the ‘working poor’ or other kinds of ‘deserving poor’ such as families, or people over 55, have actually been creating barriers to further improvements in their living standards. According to indexed figures from Statistics Canada. A single person living in Montreal is considered poor if he or she makes under 22 370 dollars a year before income tax. To earn that much, someone would have to work 52 weeks a year, 40 hours/week and get paid $10.75/hour.14 As it stands now however, minimum wage is set at 8.50 per hour; Although it will rise up to $9/hour on May 1st, this is still creating a situation where the more 300 000 people working at minimum wage – 9% of the total Quebec workforce – are getting paid less than what would be required to get them out of poverty, thus creating a class of working poor.15 Government measures need to be suited to people’s needs rather than business demands and public stereotypes.

A large number of welfare recipients do work; however, their income cannot meet their needs and thus require additional income to survive. According to government figures, of the 120 122 households receiving government aid and considered ‘fit to work’, 25% received extra income from other sources and 11,558 were receiving work income.16 The Quebec government does not seem to realize that a large number of people are chronically underemployed. They can find work here and there; however, this income is simply not enough to meet their basic needs and they are thus forced to turn to the government for help. This situation is further problematized by the government’s discriminatory practice of calculating work income for social aid recipients, not on a yearly basis like it does for all other citizens, but on a monthly basis. Beneficiaries have no incentives to work past the $200 work exemption when work is available because the money they make is immediately taken off their cheques. Paid internships with part of the salary provided by the government are often just a way for employers to get low paid workers. Once the government money runs out, employees are asked to work under the table or leave. Services like these are designed with businesses in mind rather than welfare recipients.

People receiving government money are often stereotyped as thieves who steal government money. With benefits as low as they are, and laws prohibiting work for pay, is it really such a surprise that some beneficiaries have to turn to illegal means to make ends meet. In terms of cost to society, is such petty fraud driven by the need to survive comparable to the massive fraud by multi-millionaires such as Conrad Black or the Enron executives. The government has been neglecting the most fragile segments of the population for a few years now. With the economic crisis having no end in sight, many people from all parts of society are facing the possibility of having to turn to welfare to survive. Social programs are supposed to be the safety net that protects us from poverty, but with such a big hole in the net, beneficiaries have fallen through and find themselves living in misery. People receiving government aid have to spend so much time running around to find cheap goods and services that they have no time and energy left to look at their future, care for their health, their family and find a job.

conclusion

Project Genesis in its own discourse and work to combat poverty, provides a study of the community and an analysis of a possible social transformation. The people in need, should not be ignored, and change should be sought. This is the coordinative organization aspect of community in its own discourse. Project Genesis in itself ascribes for change – it analyses the government from inter-subjectivity and sentiments of identification, to the coordination and organization of collective action. This solves both the problems of evincing a universally shared framework of experience and meaning as well as the study of communities whose constitutive features do not lie in a shared symbolic reality but in common interests and/or goals organized into action.

Here, two forms of community have been touched upon: the services provided to welfare recipients by Project Genesis are particularly community oriented similar to the proposals, actions plans; and intersubjective government coordinated actions (that is, government inaction on the matter).

With such character in community, one might consider dual power between government and Project Genesis in terms of implementing social change when investigating the connection of government language and broader social implications. •

1. Nicole Jetté. “Indexation des prestations d’aide sociale au 1er Janvier 2009”. Front commun des personnes assistées sociales du Québec. 4 November, 2008. http://www.fcpasq.qc.ca/Avis/pleine%20index%20tion%20automne%2008.html. Accessed April 13, 2009.

2. Ministère de l’Emploi et de la Solidarité sociale. Rapport annuel de gestion: 2008-2007. Québec. 2008, 34

3. Ministère de l’Emploi et de la Solidarité sociale. Rapport statistique sur la clientèle des programmes d’assistance sociale. Québec. December, 2008.

4. Ministère de l’Emploi et de la Solidarité sociale. L’indexation des prestations d’aide sociale et des prestations de solidarité sociale. Quebec. 2008.

http://www.mess.gouv.qc.ca/publications/pdf/sr_dep_montant_prestations.pdf. Accessed April 13. 2009. 2-3

5. Quebec Government. “Québec’s Tax System Indexed for 2008 – $215 Million in Taxpayers’ Pockets”. Quebec. December 12, 2007. http://communiques.gouv.qc.ca/gouvqc/communiques/GPQE/Decembre2007/12/c2445.html. Accessed 13 April, 2009.

6. Crespo, Stéphane. “Annuaire de statistiques sur l’inégalité et le fabile revenu”. Gouvernement du Québec, Institut de la statistique du Québec, 2008. http://www.stat.gouv.qc.ca/publications/conditions/pdf2008/inegalite_faible_revenu.pdf. Accessed 13 April, 2009. 75

7. p. 96

8. Ibid.

9. Baillargeon, Stéphane. “La descrimination fondée sur l’aptitude doit cesser, disent les assistés sociaux”. Le Devoir. February 21 and 22, 2009. http://www.ledevoir.com/2009/02/21/235.html. Accessed March 30, 2009.

10. Coalition pour l’arrêt du détournement des pensions alimentaires pour enfants. “Pensions alimentaires pour enfants : Québec détourne 46, 5 millions par année destinés aux enfants les plus pauvres!”. Presse-toi à gauche : Une tribune pour la gauche québecoise en marche. 7 December, 2007. http://www.pressegauche.org/spip.php?article1232. Accessed April 14, 2009.

11. Comité Luttes du FCPASQ. “L’abolition des catégories à l’aide sociale”. Front commun des personnes assistées sociales du Québec. 2009. http://www.fcpasq.qc.ca/apte%20et %20inapte-2009/argumentaire/argumentairecategories.html. Accessed 13 April, 2009.

12. Institut de la statistique du Québec. Principaux indicateurs économiques désaisonalisés ¬Québec Niveaux Annualisés. Quebec. March 16, 2009. http://www.stat.gouv.qc.ca/princ_indic/indicrm.htm. Accessed March 30, 2009.

13. MESS, “Rapport statistique”

14. Statistique Canada. Les seuils de faible revenu de 2005 et les mesures de faible revenu de 2004. Vol, 4. No, 75F0002MIF. Ottawa. April, 2006. http://www.statcan.gc.ca/pub/75f0002m/75. 23

15. Presse Canadienne. “Le salaire minimum augmentera a 9$ l’heure”. Lapresseaffaires.cyberpresse.ca. January 30, 2009.